Investing basics are the essential principles and practices that help you grow your money over time through assets like stocks, bonds, funds, and other assets. By learning the fundamentals, such as setting goals, understanding risk, and diversifying, you can steadily and securely build wealth, even if you’re starting small.

Money doesn’t grow on trees, but if you understand investing basics, it might just feel like you’ve planted a few. If the thought of investing makes you picture Wall Street wolves in sharp suits, relax. This guide is your beginner-friendly roadmap to building a financial future that feels less like a gamble and more like a well-watered garden.

We’ll keep things simple, entertaining, and digestible. By the end, you’ll know exactly how to start investing without feeling overwhelmed, or falling asleep mid-sentence.

What Are Investing Basics?

At its core, investing basics are the ABC’s of making your money work for you instead of letting it nap in your bank account. Investing means using your money to buy something; a stock, bond, property, or even a business, that you believe will grow in value over time.

Think of it like planting a seed. You don’t expect a towering oak overnight, but with time, care, and patience, your tiny seed turns into something strong and valuable. That’s the heart of investing: putting in resources today to enjoy bigger rewards tomorrow

Why Start with the Basics?

Just like you wouldn’t run a marathon without knowing how to walk, you can’t build wealth without understanding the groundwork. Knowing the basics helps you avoid rookie mistakes, make informed decisions, and sleep peacefully at night without obsessively refreshing stock charts.

“An investment in knowledge pays the best interest.” – Benjamin Franklin

Why Learning Investing Basics is Your Superpower

If knowledge is power, then financial knowledge is like having a personal money-printing machine, minus the prison sentence. Understanding investing basics gives you control over your financial future. It protects you from poor decisions, and helps you take advantage of opportunities others might miss.

Two friends each save $200 a month. One hides it under the mattress (safety first!) and ends up with $24,000 after 10 years. The other invests wisely and earns an average 7% annual return. After 10 years, they have about $34,000. One posted a different and better outcome because he knew how to make money by investing wisely.

Benefits include:

- Greater financial security

- Freedom to make life choices without money fear

- Ability to take advantage of compound growth

- Peace of mind in uncertain times

Key Components of Investing Basics

Before you dive into buying stocks or property, it’s worth slowing down and understanding the building blocks of smart investing. These investing basics act like the foundation of a house, without them, the structure wobbles.

1. Asset Classes: The “What” of Investing

Asset classes are simply categories of investments. Each behaves differently and serves a unique purpose in your portfolio.

- Stocks (Equities) – When you buy a stock, you’re buying a slice of a company. If the company grows, so does your investment. Potential for high returns, but with higher ups and downs.

Analogy: Like riding a roller coaster, you scream during the drops, but the thrill (return) can be worth it. - Bonds (Fixed Income) – Think of bonds as IOUs. You lend money to a government or corporation, and they pay you interest. Lower risk, but usually lower returns.

Analogy: More like a steady escalator ride than a roller coaster. - Mutual Funds & ETFs – These are baskets of different investments. Perfect for beginners who want instant diversification without picking individual stocks.

- Real Estate – Buying property for rental income or future resale. Can provide steady income, but requires more hands-on involvement.

2. Risk vs. Reward: The Balancing Act

Risk and reward are like peanut butter and jelly, you rarely get one without the other. Every investment has a flavor of risk. More risk often means more potential reward, but also a greater chance of losses.

- High Risk = Potential High Reward (e.g., individual stocks, cryptocurrencies)

i.e Stocks in small companies or new industries, exciting but unpredictable. - Low Risk = Modest Reward (e.g., treasury bonds, savings accounts)

i.e Government bonds, steady but not thrilling. - Balanced approach: Mixing both for steady growth and manageable swings.

The trick is, find your risk tolerance, the level of uncertainty you’re comfortable with, so your investments don’t keep you up at night. In other words, Choose your “spice level” based on your comfort zone and how long you plan to invest.

3. Diversification: Your Safety Net

“Don’t put all your eggs in one basket” might be the most overused phrase in investing, but it’s also the most accurate. Spreading your investments across asset classes, industries, and even countries helps protect you if one area takes a hit. Diversification spreads your risk across various asset classes, industries, and regions so one bad investment doesn’t ruin the whole show.

Beginners can achieve instant diversification by investing in a broad-market ETF, like the S&P 500. If tech stocks drop but you also own bonds and real estate, your portfolio won’t take the full punch.

4. Time Horizon: The “When” Factor

Your time horizon is how long you plan to keep your money invested before needing it.

- Short-term (1–3 years): Stick with safer investments. Keep risk low, think bonds, CDs, or high-yield savings.

- Medium-term (3–10 years): Mix of moderate-risk and safe assets. Think balanced mix of stocks and bonds.

- Long-term (10+ years): You can take on more risk because you have time to recover from market dips.

5. Liquidity: How Fast You Can Access Your Money

Liquidity is your ability to turn an investment into cash without a major loss in value. Stocks are generally liquid; real estate is not. Balancing liquid and illiquid investments helps keep your finances flexible.

6. Costs & Fees: The Silent Profit Eaters

Even small fees can eat a big chunk of returns over time. Always check:

- Management fees (expense ratios)

- Trading commissions

- Early withdrawal penalties

A 1% annual fee may not sound like much, but over decades it can mean tens of thousands lost.

Bottom Line

Understanding these components isn’t about becoming a Wall Street wizard, it’s about making smarter, calmer, and more confident decisions with your money. Once you grasp these investing basics, you’ll see investing less as a gamble and more as a skill you can master. Then you can design an investment strategy that fits your taste, time, and tolerance for risk, without feeling like you’re gambling blindfolded.

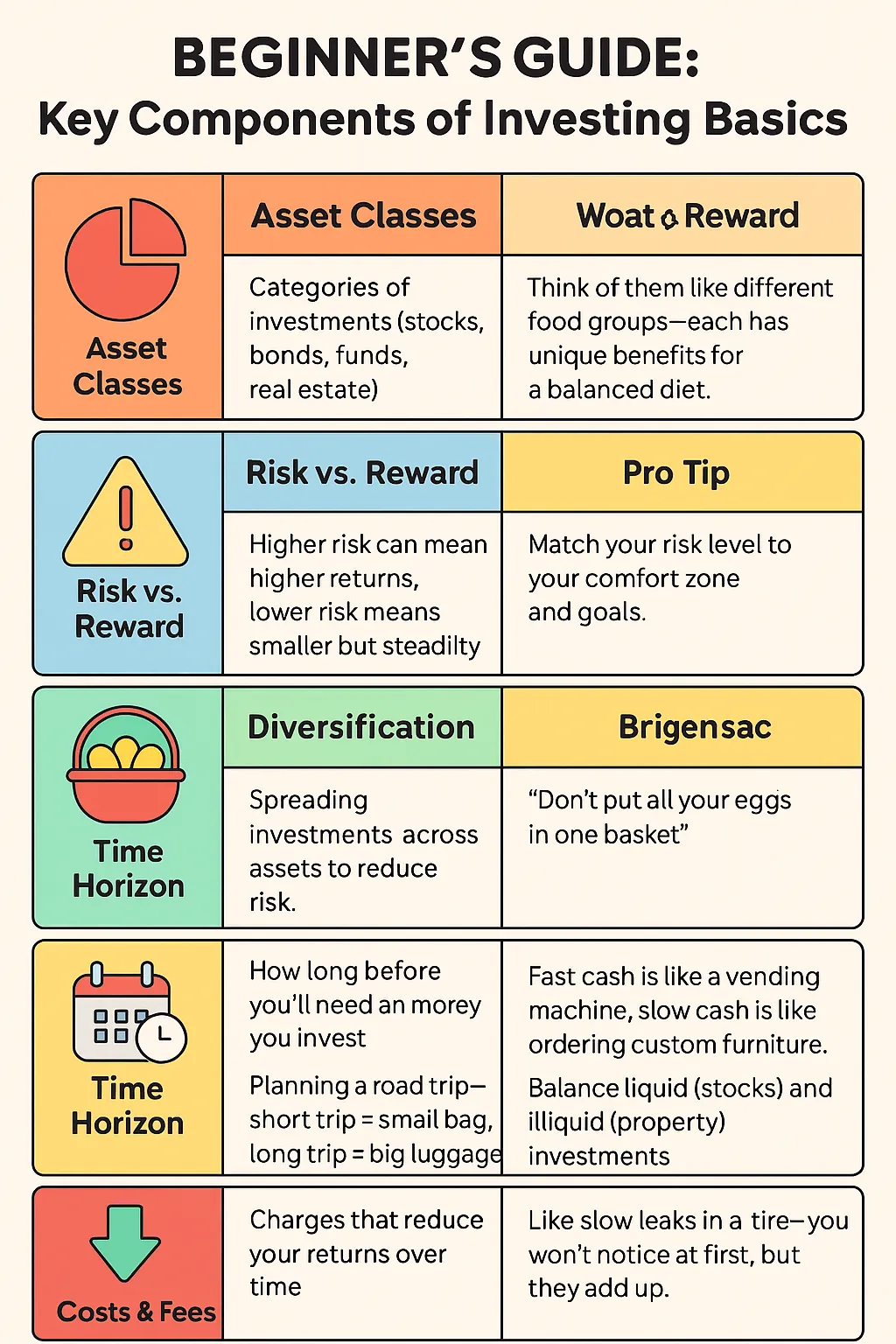

Beginner’s Guide: Key Components of Investing Basics

Component | What it Matters | Beginner-friendly Analogy | Risk Level | Pro Tip |

|---|---|---|---|---|

Asset Classes | Categories of investments (stocks, bonds, funds, real estate). | Think of them like different food groups, each has unique benefits for a balanced diet. | Varies by type | Mix several asset classes to balance risk and reward. |

Risk vs Reward | Higher risk can mean higher returns; lower risk means smaller but steadier gains. | Roller coaster vs. escalator, thrills or stability. | Low to High | Match your risk level to your comfort zone and goals. |

Diversification | Spreading investments across assets to reduce risk. | “Don’t put all your eggs in one basket.” | Lowers overall risk | ETFs and mutual funds are beginner-friendly diversification tools. |

Time Horizon | How long before you’ll need the money you invest. | Planning a road trip—short trip = small bag, long trip = big luggage. | Longer horizon allows more risk | Keep short-term money in safer investments. |

Liquidity | How quickly you can turn an investment into cash | Fast cash is like a vending machine; slow cash is like ordering custom furniture. | Depends on asset | Balance liquid (stocks) and illiquid (property) investments. |

Cost and Fees | Charges that reduce your returns over time. | Like slow leaks in a tire, you won’t notice at first, but they add up. | N/A | Look for low-fee funds and avoid unnecessary transactions. |

How to Start: A Step-by-Step Beginner Plan

Step 1: Set Clear Financial Goals

Decide what you’re investing for: retirement, a house, or simply growing your savings.

Step 2: Build an Emergency Fund

Before investing, have 3–6 months of expenses in an easy-access savings account.

Step 3: Choose Your Investment Vehicle

Beginner-friendly options include:

- Low-cost index funds

- Target-date retirement funds

- Robo-advisors

Step 4: Start Small & Stay Consistent

You don’t need a fortune to start. Even $50 a month can grow significantly over time thanks to compounding.

Step 5: Monitor, but Don’t Micromanage

Review your portfolio a few times a year, not every morning over coffee.

Common Mistakes Beginners Make

Even with the best intentions, beginners often trip over the same few hurdles when learning investing basics. The good news is most of these mistakes are avoidable if you know what to look out for. Think of them as potholes on the road to financial growth, spot them early, and you can swerve right past.

1. Trying to Get Rich Quick

Investing isn’t a lottery ticket; it’s more like a slow cooker. Give it time, and the results can be delicious. Rush it, and you’ll probably end up with something burnt (and broke).

- Avoid it: Focus on steady, long-term growth rather than chasing overnight success.

2. Chasing the Hottest Trends

If it’s all over the news and your neighbor’s dog walker is talking about it, you’re probably late to the party.

- Avoid it: Stick to your plan and choose investments you understand. Trends fade; solid fundamentals last.

3. Ignoring Fees and Costs

Even small fees can chew away at your returns over time, like termites in a wooden house.

- Avoid it: Always check the expense ratio on funds and the commission fees for trades.

4. Putting All Your Eggs in One Basket

It’s tempting to go “all in” on that one promising stock, but if it tanks, your portfolio goes with it.

- Avoid it: Diversify across asset classes so one loss doesn’t sink the ship.

5. Panicking During Market Dips

Markets go up and down, it’s normal. Selling during a drop is like jumping out of a plane mid-flight because of turbulence.

- Avoid it: Keep your eyes on long-term goals and remember that dips can be buying opportunities.

6. Not Having an Emergency Fund First

Investing before you have a safety cushion is like building a house without a foundation, it might look fine until the first storm hits.

- Avoid it: Save 3–6 months of living expenses before diving into investments.

Bottom line: Every beginner makes mistakes, but the smart ones learn fast, adjust, and keep going. Think of these pitfalls as guideposts, not roadblocks, on your investing journey.

Easy Strategies to Build Confidence

Mastering investing basics doesn’t happen overnight, but confidence grows when you start small, stay consistent, and focus on simple, proven strategies. Think of it like learning to swim, you don’t jump into the deep end right away; you start in the shallow water, maybe with floaters.

Here are beginner-friendly ways to dip your toes in without drowning in jargon:

1. Start with Index Funds

Index funds are the “set menu” of investing, you get a little taste of everything without needing to decide on each ingredient. They track a broad market index, like the S&P 500, giving you instant diversification.

- Why it builds confidence: You’re not betting on a single stock’s performance.

- Bonus tip: Look for low-fee index funds to keep more of your returns.

2. Practice Dollar-Cost Averaging (DCA)

This simply means investing a fixed amount at regular intervals, regardless of whether the market is high or low.

- Why it builds confidence: It removes the pressure of trying to “time the market” (which even pros rarely do well).

- Analogy: Like buying your favorite snack every week, sometimes it’s on sale, sometimes not, but you end up with a balanced average cost over time.

3. Go Automatic

Set up automatic transfers from your bank to your investment account each month.

- Why it builds confidence: Consistency turns investing into a habit you don’t have to think about, like brushing your teeth.

- Pro tip: Start with an amount you won’t miss, increase it as your budget allows.

4. Learn Through “Paper Trading”

Before you commit real money, try virtual investing platforms or simulators.

- Why it builds confidence: You can make mistakes without losing real cash.

- Bonus: You’ll understand how market movements affect investments without the emotional stress.

5. Start Small, Scale Slowly

Investing basics don’t require you to pour in your life savings right away. Begin with small amounts to test your comfort level.

- Why it builds confidence: Small wins early on build momentum and trust in the process.

- Analogy: It’s like tasting a dish before placing an order you get to see if it’s your flavor

Confidence Reminder:

Investing is a skill, not a gamble. The more you learn and the more consistently you apply these strategies, the less intimidating the market will seem, and the more empowered you’ll feel to take bigger, smarter steps.

Staying Motivated in the Long Game

Mastering investing basics is one thing, sticking with them when life gets busy, the market dips, or your patience wears thin is another story. You can build your foundation by learning How to master personal finance

The truth is successful investors aren’t the ones who time the market perfectly; they’re the ones who stay in the game.

1. Remember Your “Why’’

Why did you start investing in the first place? Was it to retire comfortably, travel the world, buy your dream home, or simply not live paycheck-to-paycheck?

Your “why” is your anchor. On tough days, go back to it and remind yourself: You’re building something bigger than today’s worries.

2. Focus on Progress, Not Perfection

You don’t need to hit every financial goal in record time. The market will have great years, meh years, and “why did I even check my account?” years. That’s okay.

- Tip: Celebrate small wins, like your first $1,000 invested or hitting a consistent contribution streak.

3. Tune out the Noise

The financial news cycle can feel like a rollercoaster, one headline screams “BOOM,” the next shouts “BUST.”

- Pro move: Limit how often you check your investments. Once a quarter is plenty for most long-term plans.

4. Imagine this:

At 22, you started investing $100 a month in an index fund. You never stopped, even when 2008’s market crash had your friends pulling out in panic. Fast-forward to age 52, and your account had grown to over $150,000, without your ever trying to “beat the market.”

- Lesson: Patience + consistency = quiet financial magic.

5. Think in Decades, Not Days

The stock market rewards those who let time work its compounding magic.

As Warren Buffett puts it: “The stock market is designed to transfer money from the active to the patient.”

Reminder:

You don’t have to be perfect to be successful, you just have to stay in the game. Keep contributing, keep learning, and keep your eyes on the life you’re building, not the daily noise.

Investing Basics Ideas

You don’t need a lot of money to start investing. One of the biggest myths about investing is that you need thousands of dollars just to get started. Thanks to online brokers, robo-advisors, and micro-investing apps, you can begin with as little as $10–$50. The key is to start now and build the habit, because investing basics show us that time in the market often matters more than the amount you begin with.

Investing is risky for beginners. Every investment carries some level of risk, but understanding investing basics helps you manage it. You can lower risk by diversifying your portfolio, starting with safer options like index funds, and avoiding emotional decisions when markets fluctuate. The goal is not to eliminate risk entirely, but to make informed choices that fit your comfort level and time horizon.

You may not see results sooner from your investment. Investing is a long-term journey, not a quick win. If you’re expecting overnight results, you might be disappointed. However, by applying investment fundamentals, like consistency, patience, and reinvesting your gains, you could see meaningful growth in 5–10 years. Remember, even slow growth compounds into something significant over time.

Hiring a financial advisor depends on your needs and budget. A good financial advisor can help tailor a plan, explain complex investing concepts, and keep you on track. But if you prefer a low-cost option, robo-advisors and self-directed investing platforms can guide you through the same investing basics at a fraction of the cost.

What’s the safest way to invest as a beginner? No investment is completely risk-free, but you can choose safer vehicles to start. Low-risk government bonds, high-yield savings accounts, and diversified index funds are great beginner-friendly options. Pairing these with a solid grasp of investing basics ensures you’re balancing safety with growth potential.

Quick Recap

Investing basics form the blueprint for turning financial uncertainty into opportunity. By mastering simple principles, like setting clear goals, spreading your investments, and staying consistent, you create a stable foundation for long-term growth. Whether you start with a few dollars or a larger sum, the power lies not in timing the market, but in time in the market. This guide has given you the building blocks; now it’s up to you to use them to shape a brighter, more secure future.

Practical Application

1. Goals are your compass – Without clear objectives, you’re sailing without a map.

2. Emergency funds are your safety net – Protect yourself before you leap into investing.

3. Diversification is your shield – Spread investments to protect against unexpected losses.

4. Consistency beats timing – Steady contributions grow stronger over years

Mindset matters – Stay calm through market ups and downs; patience is your secret weapon.

A Journey worth Taking

Learning investing basics isn’t just about money, it’s about freedom. It’s the freedom to make choices without fear of “Can I afford this?” It’s the ability to dream bigger because you have a plan to make it happen. The sooner you start, the more time your money has to work for you. Every great investor, from Warren Buffett to the everyday person who retires comfortably, began with the first step: learning the basics. You’ve done that today.

Let’s Wrap Up

There’s a quiet power in taking control of your financial future. You don’t need a finance degree, expensive suits, or insider connections, just a willingness to learn and the discipline to stay the course. Start with what you have, grow from there, and let your future self be the loudest proof that today’s choices mattered.

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Living the Change

The journey from beginner to confident investor is a path of patience, practice, and perspective. The first investment you make isn’t in the stock market, it’s in yourself. By embracing investing basics, you’re not just building wealth; you’re crafting a life where money is a tool, not a worry. Today you plant the seeds. Tomorrow, and every day after, you watch them grow.

Your Turn

Every great journey starts with one small, almost invisible step. Right now, you have the chance to take yours.

Imagine looking back 10 years from now, holding the life you dreamed of, traveling when you want, retiring without worry, giving generously. It all began because, on a quiet day like today, you decided to learn the investing basics and start.

Ask yourself:

- What’s one small amount I could start investing today without losing sleep?

- Which of the investing basics do I feel ready to put into action this week?

So… what’s it going to be?

Are you going to keep your money lounging around like it’s on a permanent beach vacation, or are you going to put it to work so it can bring friends home?

Start with one tiny move, $10, $20, whatever you can spare, and watch how it grows over time. Treat it like a game you can win just by showing up consistently.

Even planting the tiniest financial seed today could grow into something amazing over the years. Here’s the beautiful truth, you don’t need to be a math genius, a stock market wizard, or have a mountain of cash. You just need consistency, patience, and the courage to begin.

Remember: The future belongs to those who take action today.